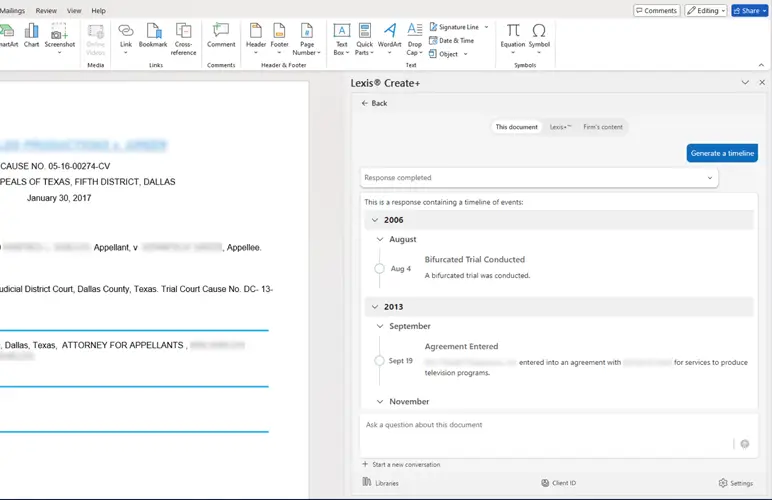

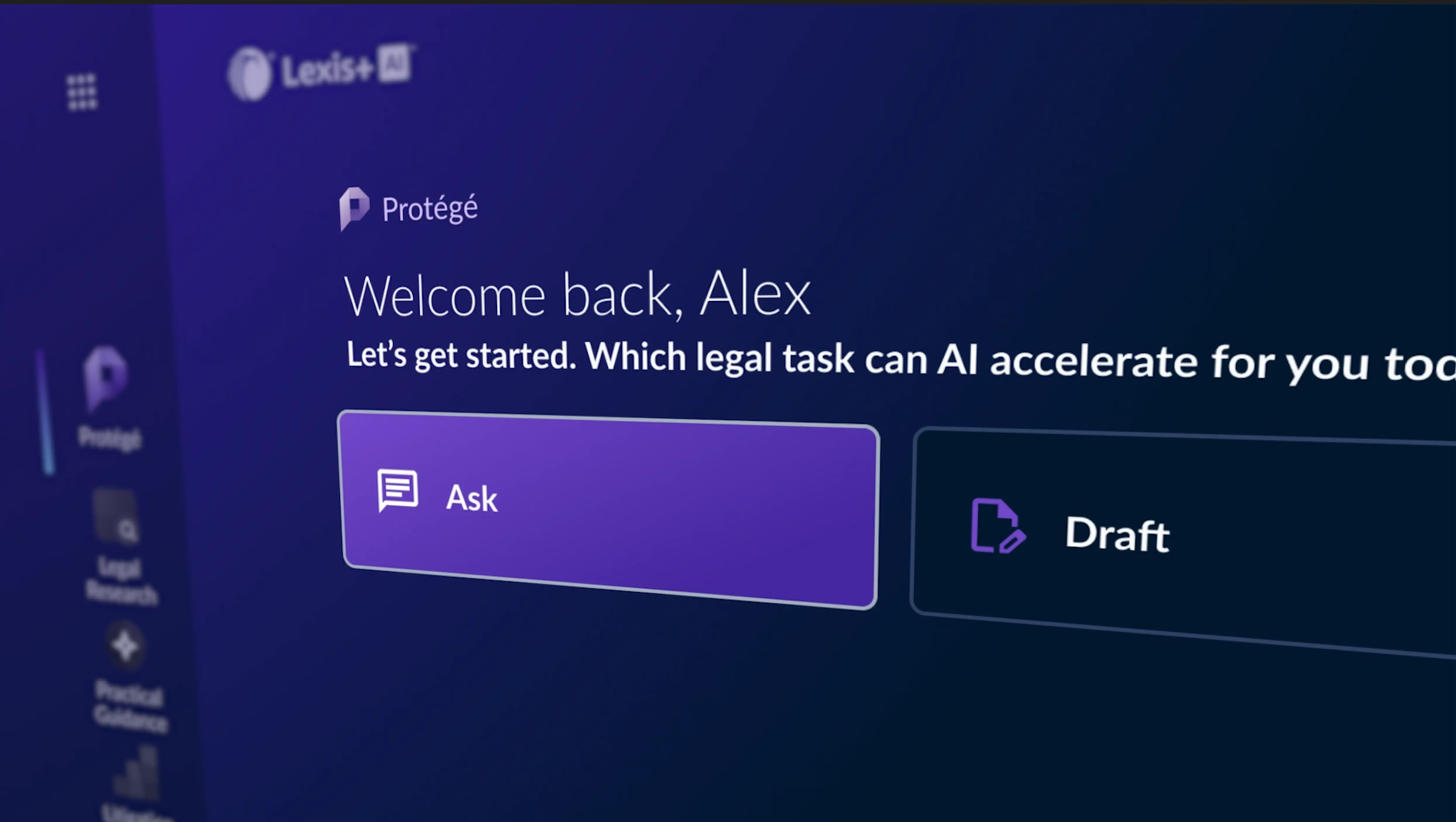

LexisNexis Protégé™ is a personalized AI-powered assistant that enhances productivity and drives next-level work quality for legal and business professionals in the LexisNexis ecosystem. Protégé is currently available in Lexis+ AI® and Lexis® Create+.

Our overall experience from the beginning and throughout has been extremely positive. We have a real partnership with LexisNexis.

In an ever-changing informational context, LexisNexis' massive source universe makes Adarga's content offering extremely versatile, and capable of serving an extremely wide variety of use cases for our customer base.

The data as a service offering by LexisNexis has enabled us to grow our business. Through global content coverage that is so comprehensive, scalable and reliable, our clients can now track the performance of their global PR investment and build market insights that support competitive advantage.